can you go to jail for not paying taxes in canada

The cra will not forget about you. In fact the IRS cannot send you to jail or file criminal charges against.

How To Avoid Jail When You Owe Back Taxes

Can someone go to jail for not paying taxes.

. May 4 2022 Tax Compliance. The question can you go to jail for not filing taxes is complicated and multifaceted. However the state has two codes that deal with tax evasion.

The short answer is maybe. However you cant go to jail for not having enough money to. Outlook on the IRS in Coming Years.

You can go to jail for not filing your taxes. These include if you simply fail to file your taxes because you forgot or were late. You can go to jail for lying on your tax return.

Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. We are asked this question frequently and sadly it is an area where we have to give people an answer they do not want to hear. But you cant be sent to jail if you dont have enough money to pay.

Its obviously a crime and maybe you need to go to jail for this. According to Section 238 of the federal Income Tax Act ignoring tax. Whether a person would actually go to jail for not.

But its highly unlikely unless you owe. Although you will not go to jail for not paying taxes neglecting back taxes can still have serious consequences. For example the IRS can garnish your wages or seize your assets.

But failing to pay your taxes wont actually put you in jail. Police will not be kicking. Penalties for Tax Fraud and Evasion.

IRS Plans to Hire More Staff. Imprisoned for up to three years OR. If not paying child support becomes a habit you will have to pay what you owe and interest and other penalties.

If convicted you are guilty of a felony and can be. It is possible to go to jail for not paying taxes. Tax fraud and evasion can lead to fines up to 250000 for individuals and up to 500000 for corporations.

You may also face a prison sentence of up to. However failing to pay your taxes doesnt automatically warrant a jail sentence. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000.

The state can also require you to pay your back taxes. While there is generally a 10-year limit on collecting. Can you go to jail for not paying taxes in canada.

Unpaid taxes arent great from the IRSs perspective. Yes you can be sent to prison for not paying tax. The general answer for how long you will spend in county jail for tax evasion in California is one year.

The IRS can take many actions against you if you dont pay your taxes including garnishing your wages levying your bank account seizing your assets putting a lien on your. However the IRS also has a long time to try and collect taxes from you. Not being able to pay your tax bill.

Ahead of the 2023 tax filing season the IRS has hired 4000 new employees to work at the agency. The short answer to the question of whether you can go to jail for not paying taxes is yes. OK Im not a Canadian in particular but I can answer the question with broad knowledge of how MOST revenue-collecting services in modern western Democratic developed.

Penalty for Tax Evasion in California. The short answer is yes. If you ignore the rules and are not paying child support.

Fined up to 250000 for an individual offender or 500000 for a corporation OR. The state can also. At first we want to say that if you are not paying child support you not doing a good thing.

Answer 1 of 9. Technically a person can go as long as they want not filing taxes. Can you go to jail for not paying taxes in canada.

The Canadian state recognizes tax-evading as a criminal offense punishable by prison time and hefty financial penalties.

Preparing Tax Returns For Inmates The Cpa Journal

What Happens If You Can T Pay Your Taxes Ramsey

Tax Time 2015 Why Tax Cheats In Canada Are Rarely Jailed Cbc News

Thoreau S Death Mask Or When He Went To Jail For Not Paying War Taxes Inverse Poetry Archive Collections Hosted By The Indiana State Library

Unfiled Taxes What If You Haven T Filed Taxes For Years Kalfa Law

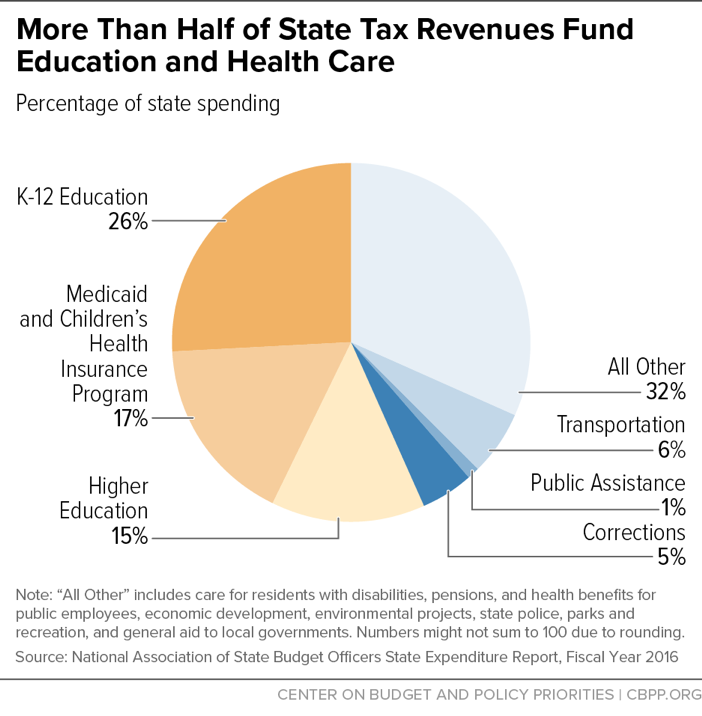

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

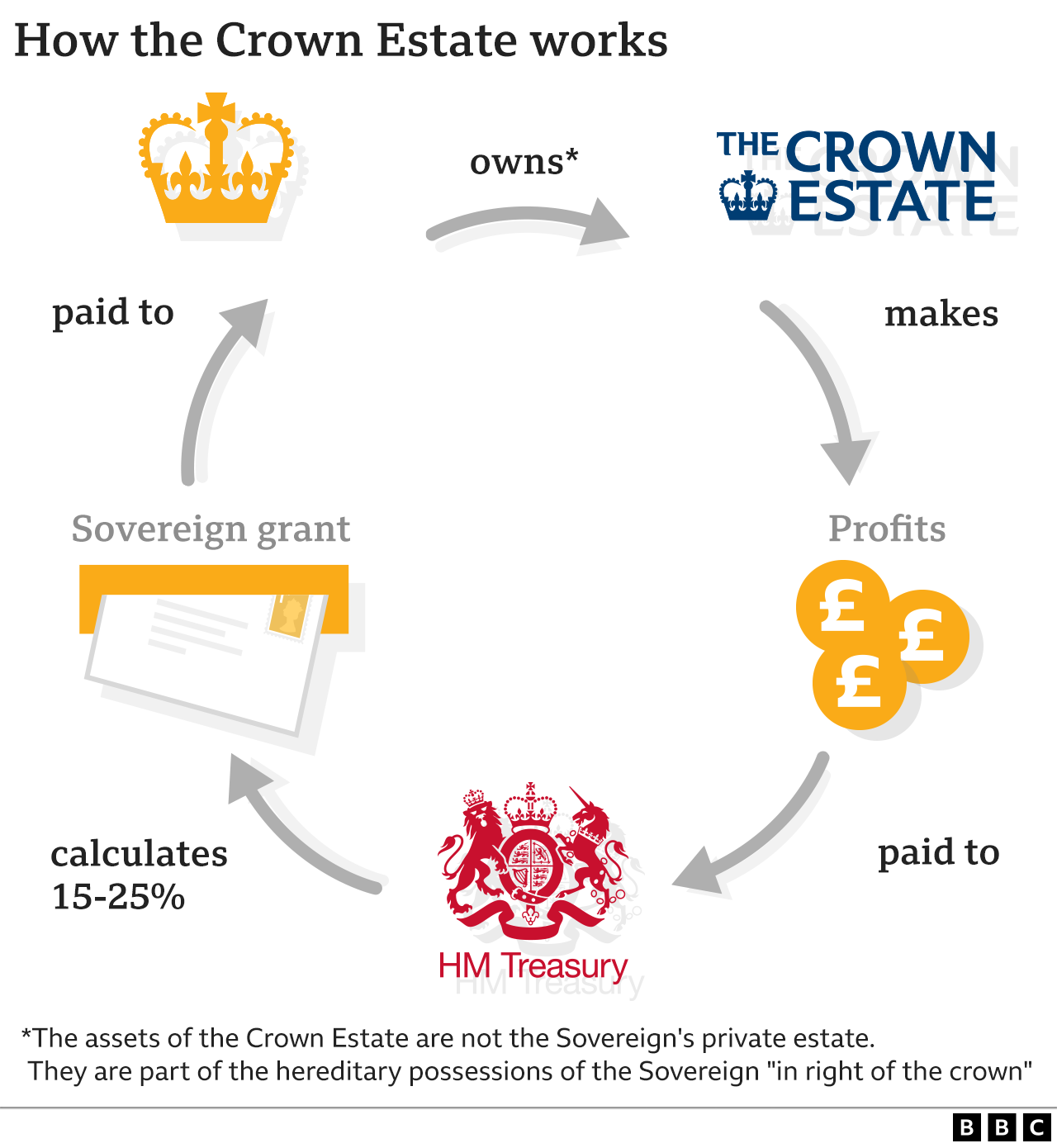

Royal Finances Where Does The Queen Get Her Money Bbc News

Jersey Shore S The Situation Is Going To Jail For Tax Evasion How To Avoid The Same Fate Marketwatch

Canada Crypto Tax The Ultimate 2022 Guide Koinly

What Happens If Taxes Are Not Filed Canada 2021 Remolino Associates

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

Can I File My Boyfriend S Taxes If He Is In Jail

Can I Receive Us Based Income While Working Remotely For A Us Company Without A Work Visa Quora

Can You Go To Jail For Not Paying Child Support In Canada Family Lawyer Edmonton

Small Business Payroll Taxes Adp